is maine tax friendly to retirees

Is Maine tax-friendly for retirees. Luckily while you have to watch out for the Maine state income tax your.

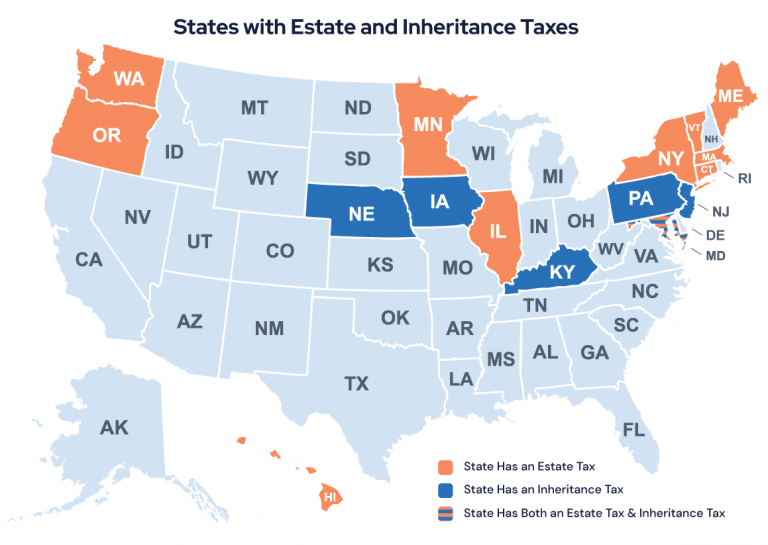

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income.

. Income tax rate 65. The states property taxes are somewhat higher than the national average at a 130 effective rate. Seniors who receive retirement income from a 401k ira or pension will pay tax rates as high as 715 though a small deduction is available.

Property tax exemption for seniors 65 and older or surviving spouses 50 of first 200000 in actual value exempt No estate or inheritance tax. Password Please register to participate in our discussions with 2. See our Tax Map for.

On the other hand if you earn more than 44000 up to 85 percent of your Social Security benefits may be taxed. It also has above average property taxes. 29 on income over 440600 for single filers and married filers of joint returns 4 5.

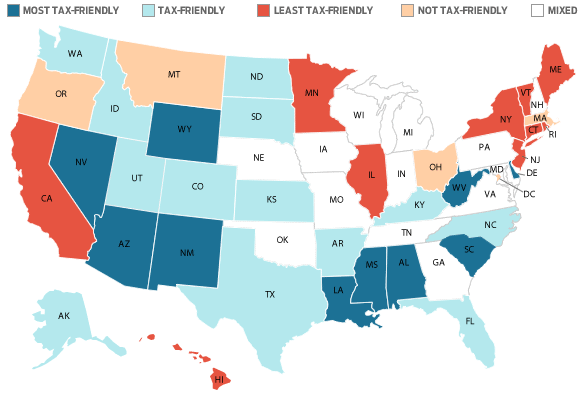

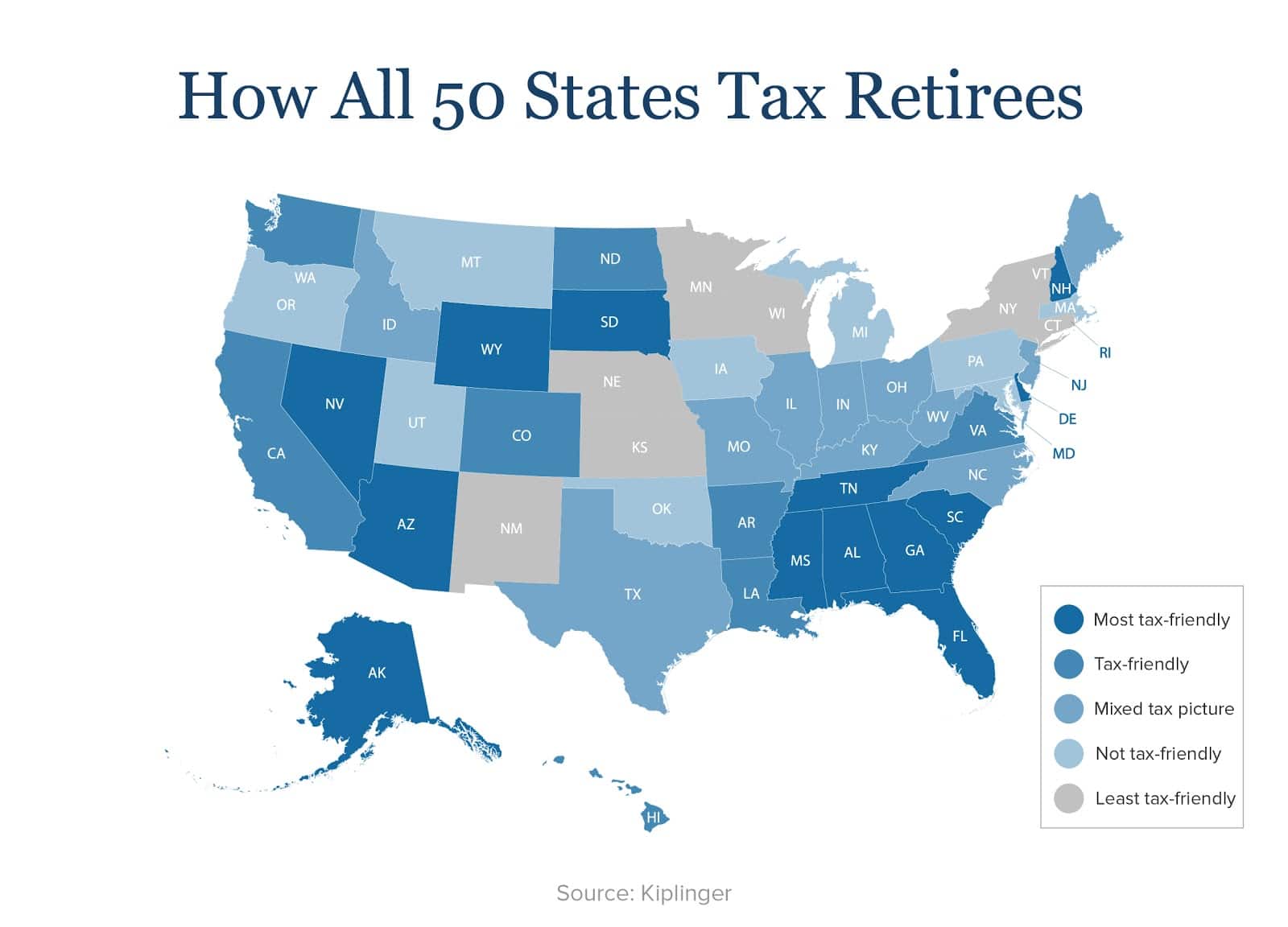

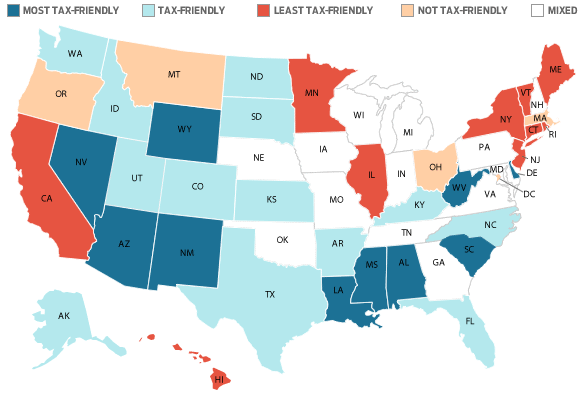

State sales and average local tax. Is Maine Tax Friendly To Retirees. How all 50 states rank for retirement friendliness.

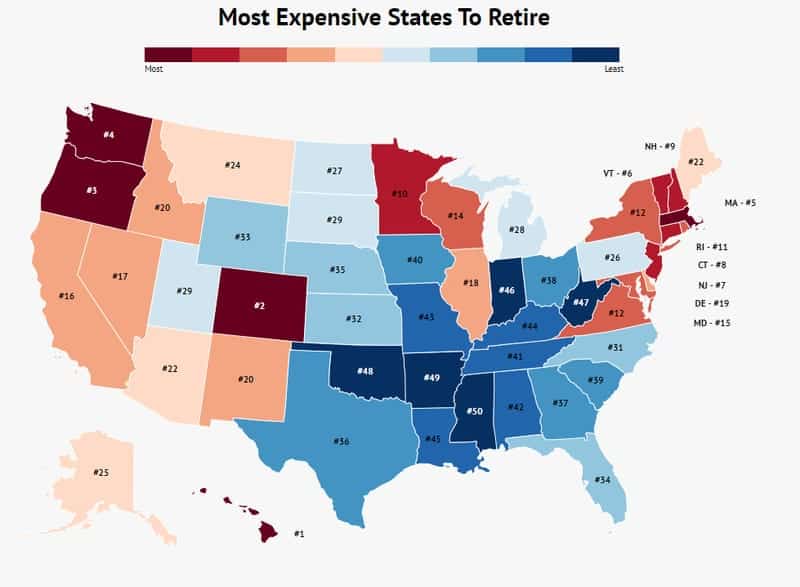

In a state like Wyoming which has no income tax along with low sales and property taxes retirees can expect to have a very small tax bill. Average property tax 607 per 100000 of assessed value 2. Is my retirement income taxable to Maine.

State tax on Social Security. If you believe that your refund may be set-off to pay a debt other than an income tax debt you must contact the other tax department or agency directly to request injured spouse relief. Married filers that both.

The state has the highest percentage of workers who are 65 years old or older. Alaska holds the top spot in WalletHubs taxpayer ranking and also has the most elder-friendly work market for retirees who might want to earn extra income. On the other hand taxes in a state like Nebraska which taxes all retirement income and has high property tax rates the overall state and local tax bill for a senior could be thousands of dollars higher.

State Sales Tax Rate. In this case the state is coming in at 6 due to it being quite tax friendly for retirees. California will tax you at 8 as of 2021 on income over 46394.

The newstory refers to the ten states as tax hells and do not live here for your second act list. Maine does not tax social security income. Most residents pay 104 percent of the propertys market value.

Estate and Inheritance Tax. Social Security and public pensions are exempt from taxation but the Aloha State taxes private pensions and income from retirement saving plans at rates of up to 11. Maines property taxes are also pricey plus Maine charges an estate tax ranging from 8 to 12 on estates valued above 57 million.

Is maine a tax friendly state for retirees. Hawaiis top rate of estate. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov.

6 on the list. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10. Flat 463 income tax rate.

South Carolina has the fourth-lowest property tax rate and. Social Security is exempt from taxation in Maine but other forms of retirement income are not. Maine One of Ten Tax Unfriendly States Augusta.

Most residents pay 104 percent of the propertys market value. Withdrawals from retirement accounts are taxed. 323 on all income but Social Security benefits arent taxed.

Low income apartment User Name. Sales taxes and property taxes are relatively moderate. Retirement income tax breaks start at age 55 and increase at age 65.

According to Sperlings Best Places an online data resource the cost of housing. For state income taxes Virginia doesnt tax Social Security. The 10000 must be reduced by all taxable and nontaxable social security and railroad benefits.

For nature lovers and those looking to retire in a place that offers the feeling of being far away from the rat race this may be the place. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation.

Those are all good reasons to choose Maine as a retirement destination but what about the states tax system. For retirees the Old Dominion offers a few tax breaks here and a few tax breaks there to create a friendly overall tax environment. City-Data Forum US.

Maine Retirement Tax Friendliness Smartasset

Maine Retirement Tax Friendliness Smartasset

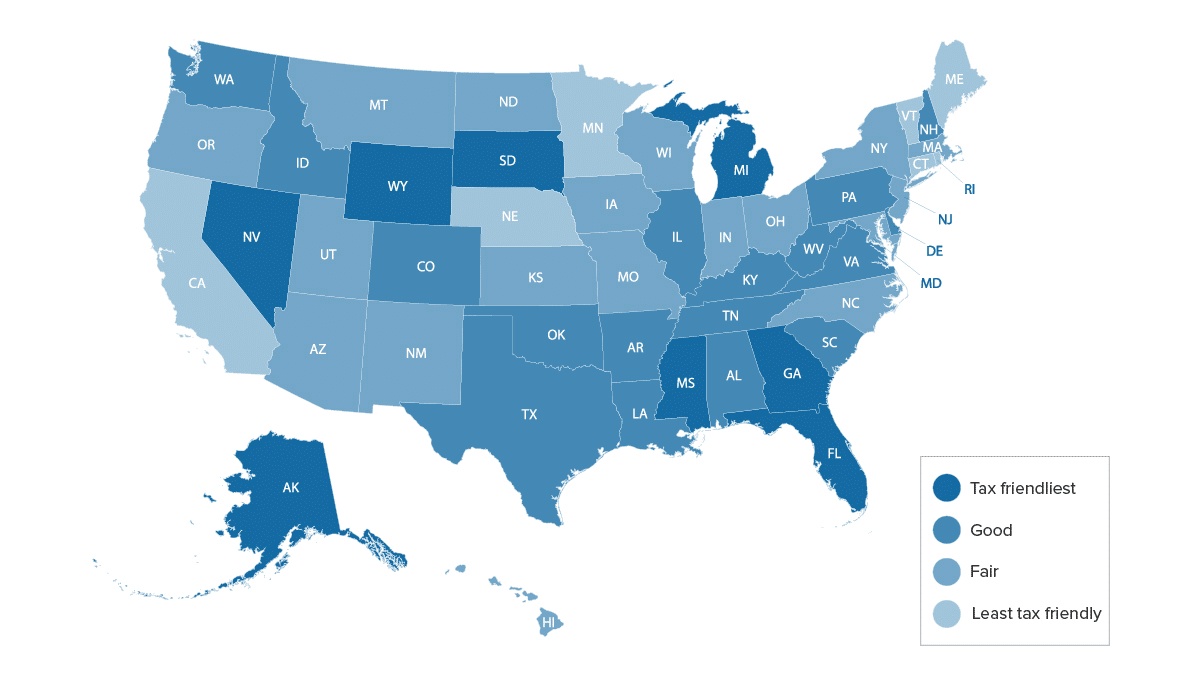

The Most Tax Friendly States For Retirees Vision Retirement

Best States To Live In Retirement

Least Tax Friendly States For Retirement Kiplinger S Personal Finance 03 17 14 Skloff Financial Group

How To Plan For Taxes In Retirement Goodlife Home Loans

Most Tax Friendly States For Retirees Ranked Goodlife

Aloha State Makes Least Tax Friendly List Maui Now

A Guide To The Best And Worst States To Retire In

A Guide To The Best And Worst States To Retire In

Most Tax Friendly States For Retirees Ranked Goodlife

7 States That Do Not Tax Retirement Income

A Guide To The Best And Worst States To Retire In

Skowhegan Caribou Top Ranking Of Tax Friendly Places To Retire In Maine

Skowhegan Caribou Top Ranking Of Tax Friendly Places To Retire In Maine

Maine Retirement Tax Friendliness Smartasset

Don T Retire In These 10 States If You Want To Keep Your Money The Most Expensive States To Retire Zippia

Most Tax Friendly States For Retirees Ranked Goodlife

Retiring In Maine Vs New Hampshire Which Is Better 2021 Aging Greatly