private reit tax advantages

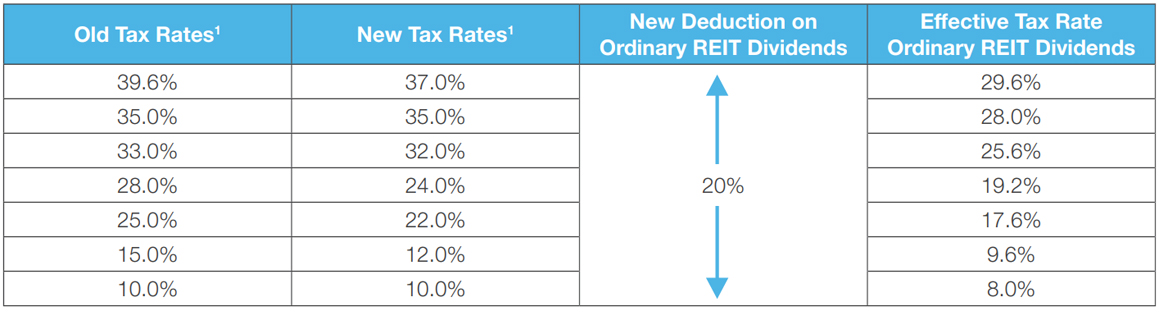

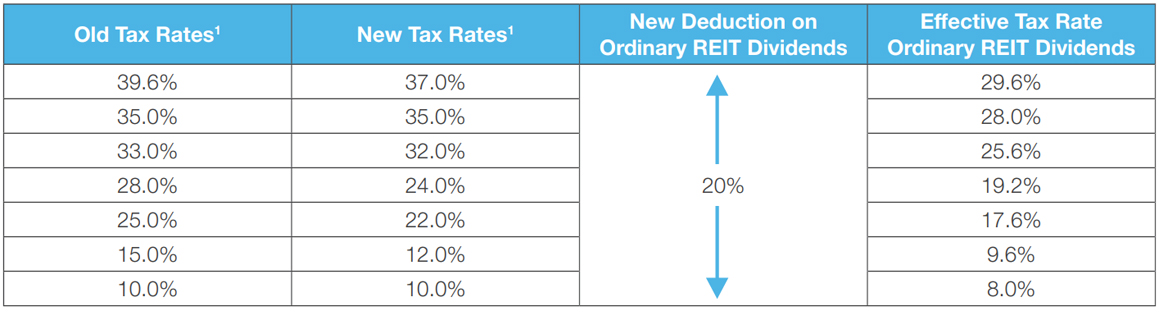

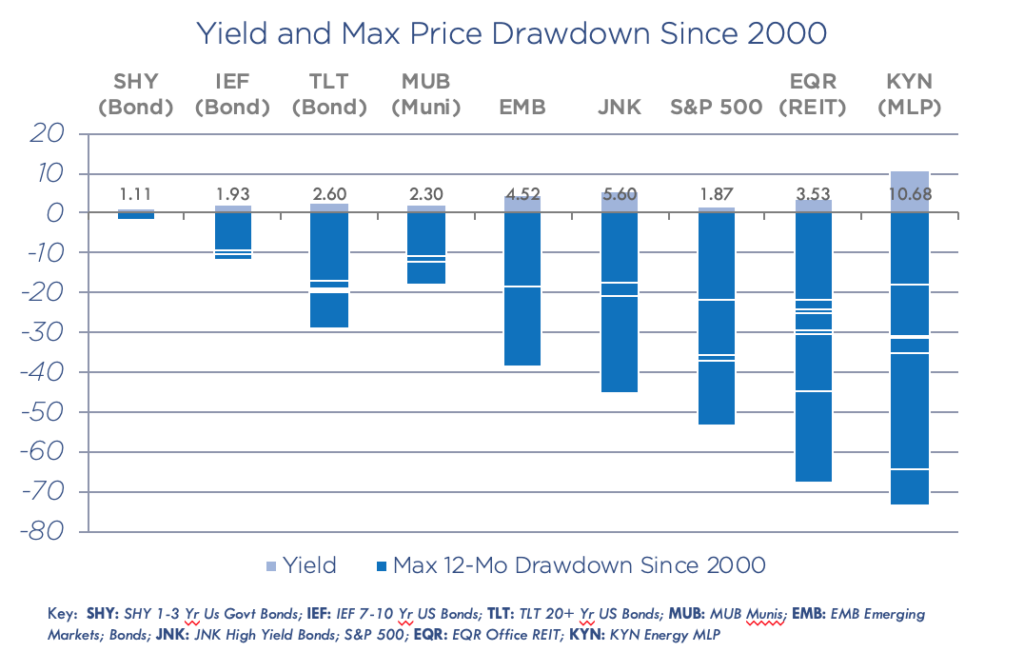

162 trade or business. After-tax yield is reflective of the current tax year which does not take into account other taxes that may be owed on an investment in a REIT when the investor redeems his or her shares.

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

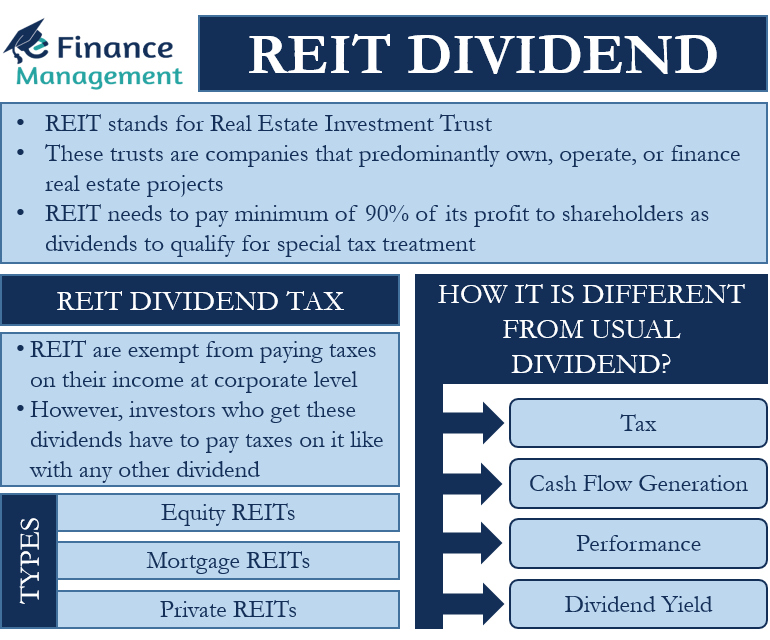

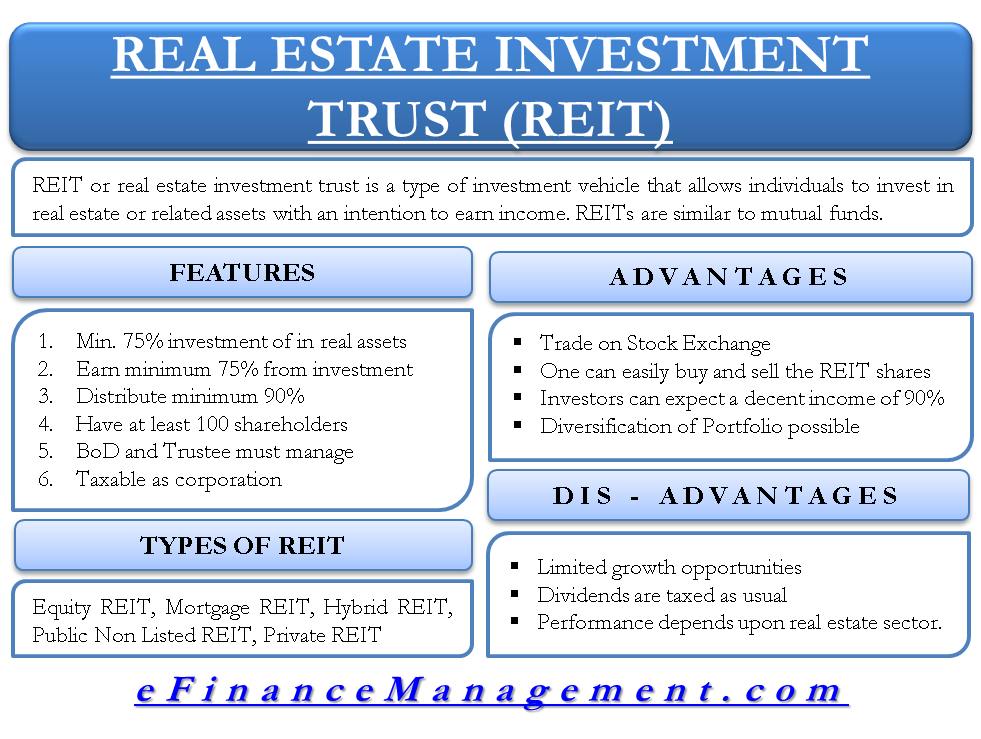

REITs are partial conduits.

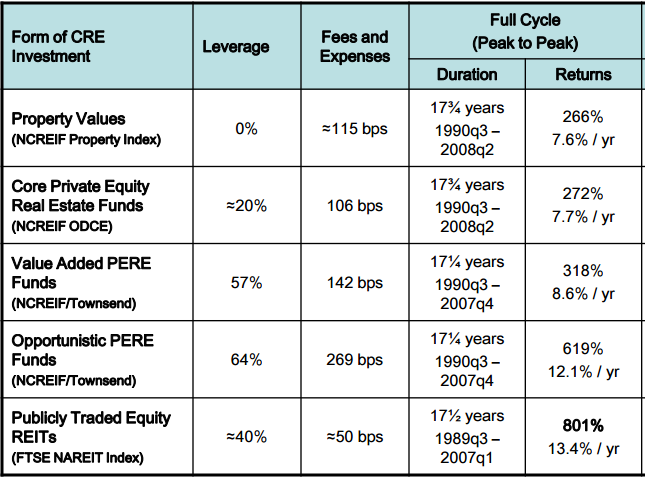

. Ad With Decades Of Experience Let Cornerstone Help With Tax Advantaged Investments Today. It receives the same tax treatment as those publicly traded but that is where most of the similarities end. The use of real estate investment trusts REIT in real estate private equity fund structures has long been advised as a prudent strategy.

The potential to create passive income with real estate no landlording required. Cornerstone Combines The Power Of 1031 Securitized Real Estate. REITs are taxed as a corporation but are also afforded some of the benefits of a flow through entity.

If the REIT held the property for more than one year long-term capital gains rates apply. A REIT Real Estate Investment Trust is a tax-advantaged investment vehicle created in 1960 as part of the Cigar Excise Tax Extension with the purpose of buying and holding real estate. Moreover there are a.

Nevertheless numerous private REITs have been set up as so called incubator REITs in anticipation of taking the fledgling REIT public in the future. Ad With Decades Of Experience Let Cornerstone Help With Tax Advantaged Investments Today. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options.

A private REIT is a tax advantaged entity who offers securities to accredited investors through direct marketing financial advisors and broker-dealer networks. Cornerstone Combines The Power Of 1031 Securitized Real Estate. Ad The potential to earn passive income with real estate without buying an entire building.

Leverage PIMCO One Of The Largest Most Diversified Real Estate Managers In The World. Its shareholders are taxed on dividends received. Ad Diversification low investment to value ratio risk adjusted returns zero leverage.

Form 1099-DIV is issued to persons who have been paid dividends. Ad Bold Trades on Real Estate - In Either Direction Bull or Bear. Voyager Pacific real estate equity fund is designed to generate years of passive income.

In their simplest tax form a REIT functions like a hybrid of the two and provides the best. View detailed information about property 97 Huckleberry Ct Readington Twp NJ 08887 including listing details property photos open house information school and neighborhood data and. A listed investment company LIC is an Australian closed-end collective investment scheme similar to investment trusts in the UK and closed-end funds in the United States.

The private equity firm passes all tax benefits on to its investors including depreciation and capital recapitalization while REIT payouts are taxed at an investors higher. Specifically tax-exempt and foreign. This may become relevant when the.

Less commonly examined in the industry however is whether the general partner entity may be engaged in a Sec. Well work closely with your tax advisor and attorney to prepare your investment plan. Income insurance provides benefits to retirees and those who become disa-bled.

A REIT unlike a regular corporation deducts dividends paid. Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank mutual fund or real estate fund. Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while.

The second way is to purchase shares of a non-traded or private REIT. Vides cash benefits to low income families as well as the aged blind and disa-bled. Ad Get Active Management With Real Estate Expertise Across Major Asset Classes Markets.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Based on a REITs long-term.

Reit Dividend All You Need To Know

Sec 199a And Subchapter M Rics Vs Reits

Guide To Reits Reit Tax Advantages More

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services

Are Real Estate Investment Trusts Reits A Good Investment Right Now The Pros And Cons Financial Freedom Countdown

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Guide To Reits Reit Tax Advantages More

Reit Or Real Estate Investment Trust All You Need To Know

Reits Vs Real Estate Mutual Funds What S The Difference

Real Estate Investment Trust Reit Meaning Type How To Buy

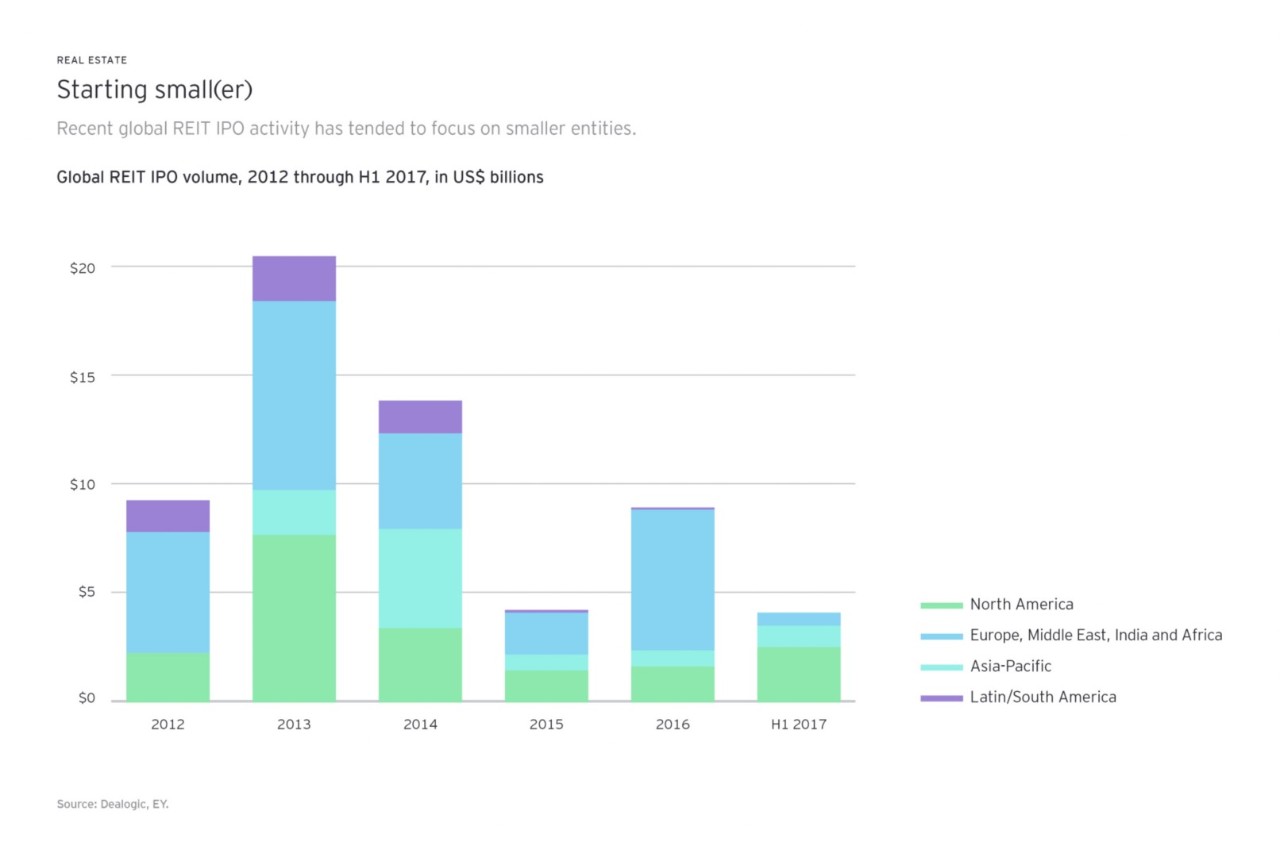

How Reit Regimes Are Doing In 2018 Ey Slovakia

The Definitive Breakdown Of Reits Vs Private Reits Aspen Funds

Reit Investing 2022 Beginner S Guide Real Estate Investment Trusts